Hi, I'm Des

I help you de-risk technology investments

Technical due diligence for acquirers and investors. I identify the hidden liabilities in software assets so you can plan ahead, negotiate from strength or even walk away.

What You Get

I partner with acquirers, investors, and deal teams to de-risk technology acquisitions before capital is deployed.

By identifying hidden liabilities and quantifying technical debt, I provide actionable intelligence that translates directly into:

- A clear picture of what you're actually buying before you commit

- Quantified technical debt with remediation cost estimates

- Leverage to renegotiate the deal price based on actual findings

- Confidence that the IP is clean, transferable, and defensible

- Evidence of scalability to support your growth thesis

Background

- Founder: Built a VC-funded, category-leading marketplace in the UK (Fixed)

- Transaction: Successfully exited software assets

- Technical: Former Top-Performing Solution Engineer at Google & Looker

- Industry: Various data and finance roles at Firebolt, IBM, Stackdriver, Citi

- Education: Computer Science, Technical University Dublin (TUD). Finance, D'Amore-McKim School of Business (NEU)

Our Process

A structured technical assessment that gives you the intel to close with confidence.

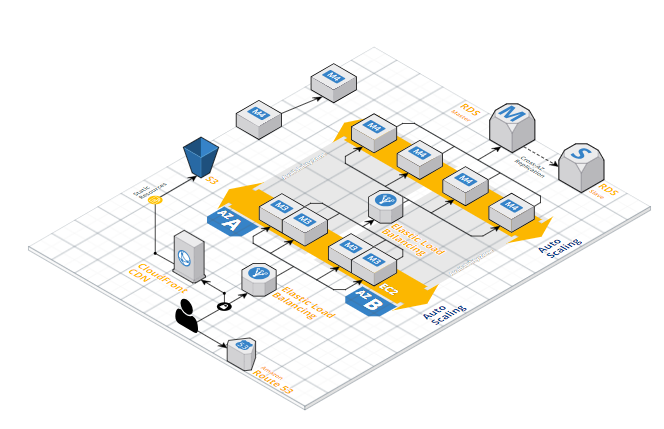

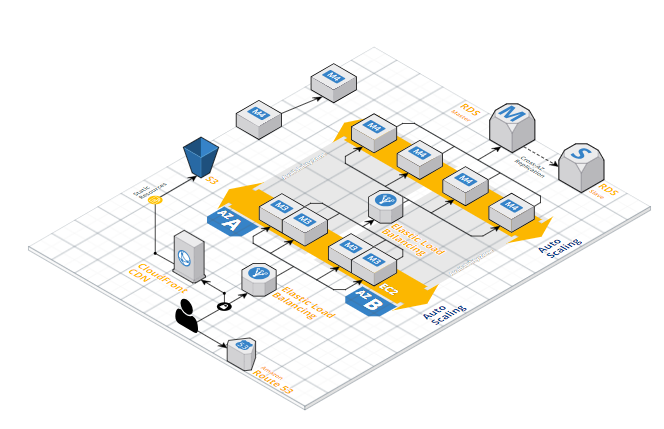

Access & Infrastructure

Secure a connection to begin assessment.

We start by establishing a secure connection to the estate in question. This gives us an initial picture of the stack, infrastructure and architecture. This allows for the remote analysis that follows and gives us a view of the IT OpEx. At this point we also send out a data request document to the team to get ahead of other information.

Investment

Clear pricing for clear deliverables.

Founder Package

Due Diligence Preparation Guide

$1,000

$2,000

- Technical Due Diligence preparation framework and checklist

- Overview of tools and methodologies buyers use

- Documentation and presentation guidance

- Self-assessment templates

- Guidance on valuation and potential buyers

Best for: Founders looking to sell or raise funding

Buyer Package

Complete Due Diligence Report

$8,000

$12,000

- Rapid infrastructure visualization and asset verification

- Red flag liability sweep with IP and license audit

- Delivery engine and culture audit with team interviews

- Detailed remediation budget with cost-to-fix estimates

- Traffic light executive summary with key findings

Best for: Serious buyers entering Due Diligence phase

Post-Close Package

Fractional CTO Advisory

From $15,000

- Post-close integration roadmap and technical planning

- Migration and system consolidation support

- Technical debt remediation guidance

- Ongoing advisory via monthly strategic calls

- Priority access for technical questions

Waitlist offering - limited availability

If the deal is called off during the process, you only pay for the work completed up to that point.

Frequently Asked Questions

Common questions about our Technical Due Diligence process for M&A transactions and VC fundraising.